155 Redpath Condo For Sale*

ONE LEFT – THE BEST INVESTMENT UNIT

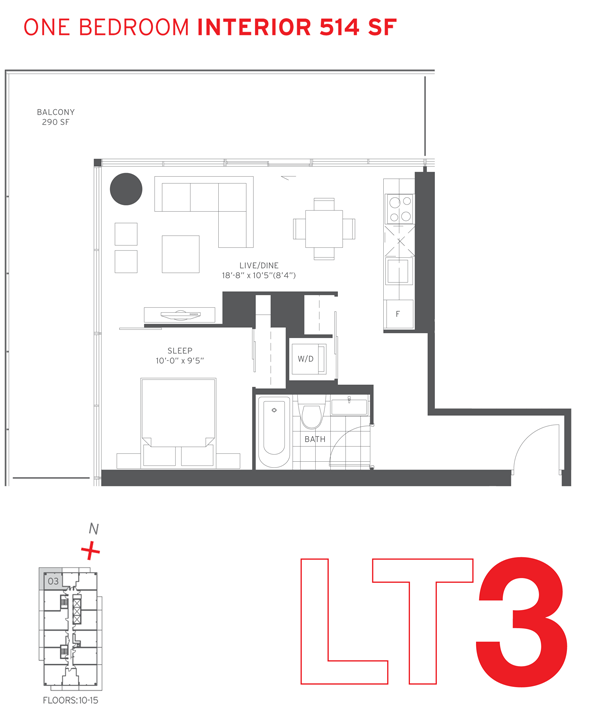

Above is, IMHO, THE BEST Investment Unit that was offered for sale at the 155 Redpath Condos VIP One Night Sale last week. Guess what? We have the last available model available for sale on the 8th floor. Read below for info on this unit and why I believe it’s the best investment  condo fro sale, out of the entire stock offered.

Here’s the info on the condo:

- 1-Bedroom

- 514 sq ft indoors

- 290 sq ft outdoors (!!)

- 8th floor – above the pool floor

- North-East View (West will be blocked, South has premiums)

- Most efficient layout in the entire building

- Only 7 units of it’s kind at 155 Redpath Condos

- Last unit available

- Highest ROI for unit of it’s kind – according to our calculations

- Highest potential for appreciation in the project – according to our estimates

- Rent Guarantee at approx $3.sqft 2+1 years

- Expected return 10-12% – according to the ROI sheets link here

OK So why THIS unit and not another one?

- Corner Unit!

- Rare, only 1 of 7 in the entire project (think rental rates and re-sale values)

- High enough above the noise and the pool

- Low enough not to be too expensive

- Priced well below 400k, meaning lots of room for growth

- Efficient floorplans and wrap-around balcony mean

- Should achieve similar rents to it’s bigger brother, the 613 sq ft corner unit, which costs $400,000

- Should achieve better ROI than the 613 corner unit, bc it’s price is much lower yet rents are higher in relation

- Should achieve faster AND higher appreciation in relation to the equivalent 613 sq ft corner unit, bc the current price is much lower, so more room for value growth

- You can opt-in to the rental program and get $3/sq ft, or about $1542/mo.

- You may opt-out of the rental program and get a 3% DISCOUNTÂ ON THE PURCHASE PRICE

- In my opinion, the lease rate by time you get your keys will be closer to $4 Sq ft, $1,800 – $2,000/mo

- In my opinion, the actual ROI you an achieve with this unit is ONE OF THE HIGHEST if not THE HIGHEST at Redpath Condos

- In my opinion, the actual $ returns you may achieve may easily beat any other investor that also purchased in this sale.

The price for this unit is $342,900

The Approx. return from rents is $1,542/mo.

Here’s what I will do for my clients:

Buy the unit outside of the Rental Guarantee program. get a 3% discount on the price, now you’re looking at approx $332,613

Rent the unit outside of the program, get approx $1,800-$2,000/mo.

I will find you the tenants and lead you, step by step, through the entire process from buying to closing and leasing of the unit.

Some ideas regarding possible Appreciation and Returns:

Buy for 333,000. At the end of a 6-year cycle, (3 for construction, 3 for rental), and with current mid town appreciation of 5-8% per year, assuming only 5% annual growth, your condo may be worth in the $400,000 – $433,000 range. Remember, corner unit and large terrace! Who would not like that? we’re expecting fast appreciation here. The ROI here (gross, cash on cash) is from 100% to 150%. In easy terms: you may triple to quadrouple your investment.Â

Is that real? yes, it is. If you can do that ONCE PER YEAR, your retirement will be that much sooner. Right?

And what about cashflow?

Looking at the Investment Package (click to download), the left column shows a 10.8% return, with a return of $1,630 on a 564 sq ft unit. This unit is sell for about same price (slight premium for terrace), with lower condo fees of approx $252/mo. about same in taxes, $207 and about same mortgage, $1052. Over all we’re saving $24/mo. So our cost per month is $1,521/mo.

I’ll now assume income of $1,850/mo, which give me a positive cash flow of $329/mo. or $3,948/yr. Over the term, I’m making a positive cash flow of $11,844. With my deposit of $66,000, my return is astounding 18%. Can you beat that?

And remember, the 18% is for cash flow only. I also project a $70,000 – 100,000 appreciation for the unit, IN ADDITION to the cash flow.

How do I know all that? everything I write is is of course, based on my experience and knowledge of the Toronto condo market and my own experience as an active investor . I have been buying and selling my own properties for 15 years now, and have consistently beat the market time after time, with every purchase I have ever made. I have also seen other “investors” losing their shirts bc they have chosen to receive ill advice from “experts” in the field. These are not expert. These are “Order Takers”. The herd a group of clueless people into a room and make them sign the contracts. Before you make a decision to buy or sell a property, make sure the agent you are working with puts their own money where their mouth is! Simply ask them: have you bought properties before? How many times? How many do you own now?

Fill this form now, and we’ll contact you right away:

Download the investor package here:Â http://yorkvilleluxuryrealestate.com/155-redpath-price-list-floor-plans/

155 REDPATH VIP SALE

155 REDPATH VIP SALE

155 Redpath Condo for sale. Here is the pool.Â

Download Investor Package [click]

* Representations and information contained herein do not form part of any Agreement of Purchase and Sale. Hersh Litvack sales representative, The Hersh Litvack Team, Re/Max Realtron Realty Inc. and/or Yossi Kaplan and/or Your Choice Realty Brokerage is not affiliated with Burnac or any brokerages. The parties do not warrant or represent any or all of the figures and statements above. No placement of mortgage is guaranteed and it is the responsibility of each purchaser to arrange suitable financing. You are advised to verify all figures and statements with your accountant and obtain independent legal advice. Price and availability are subject to change without notice 2014 E.&O.E.

You must be logged in to post a comment.